FinnCham introduced the new member of the Finnish-Latin American Trade Association by interviewing its Latin American specialists in Helsinki Mr Janne Aalto and Mr Rodrigo de la Cruz López, CFA:

President Macri keeps applying a free-market reform agenda to try to overhaul economy. How do you see the economic situation of Argentina in overall?

Argentina is the second largest economy in South American with a young and growing population of around 44 million inhabitants. After years of isolation and populist policy, the actual government is pushing business friendly reforms to lead the country back to an economic path of growth and stability. The key agenda of the current administration is to boost job creation, increase the standard of living and reduce poverty by business friendly reforms. The actual government is doing everything possible to feed economic growth, entrepreneurship and attract investors to receive considerable amounts of investments. Current Argentinean president, Macri was elected in December 2015, immediately starting with a return to the international financial markets, which have been closed to the country since 2001.

As soon as the current administration took over in December 2015, the government started to implement a battery of reforms in order to make a total turnaround in the country’s economic policies and targets. Argentina has returned to international capital markets with a 4x oversubscribed USD 16bn offering of sovereign debt, peso started to float freely and currency capital controls have been eliminated, allowing the country to come back in 2017 for a sovereign series of 100 years tenor, which is not common for emerging markets fixed income instruments.

Argentina is a country which used to have a higher GDP per capita than many European countries during first half of 20th century. However, after decades of populism, corruption and mismanagement the country has decreased its level and increased the poverty level, which is one of the current main concerns to provide a solution.

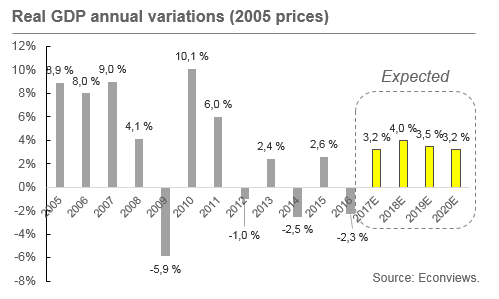

Now, Argentina has turned the page. First time in decades at the same time, GDP has started to increase with an estimate of +3 % in 2017 and inflation and unemployment are decreasing. However, the government has still challenges ahead to tackle such as fiscal deficit and inflation.

Which other business friendly measures have been taken after President Macri was elected in 2015 in order to boost the economy?

Argentina’s business environment has changed dramatically, but for better. Macri’s government has very ambitious and business friendly plan. Actual government is opening the country to international arenas after years of isolation and protectionism.

As mentioned before, elimination of capital controls, reduction in export tariffs, tax reforms and many more, Argentina is trying to attract international investors by creating interesting and attractive business opportunities. However, after populism and extremely protectionism era Argentina needs time to re-build trust and confidence for the markets. The first year of Macri’s administration in 2016 was not as good as the markets were expecting but as big changes take time to show improvements, finally, after 2016’s take off, during 2017 the economy has begun to recover heavily and firmly. Macroeconomic outlook is very positive. GDP has started to grow and the estimate for the year 2017 is around 3 % increase. Unemployment is decreasing also and one of the key agendas of the actual government is to create more jobs by economic growth in both private and public sectors.

On the other hand central bank is still struggling with inflation, nevertheless inflation has started to decrease. According to Macri’s latest interview in Bloomberg news, Argentina has turned the corner. “Without a fixed exchange rate, without any type of price controls, we have been reducing inflation. I am more confident than ever that in 2019 we will have single-digit inflation.” (1) Shortly said Argentina is back in business and economic outlook is very positive for years ahead.

So, Argentina is back in business, but how is the situation in terms of International trade after years of protectionism?

One of the key agendas of the actual government is to put Argentina back to the word after decades of protectionist policy. Argentina is an active member of WTO, member of G20 countries and actually hosting 2018 G20 presidency. Argentina is a founding member of Mercosur – South American trade block together with Brazil, Uruguay and Paraguay. Argentina is also applying to join OECD countries.

Worth mentioning for all investors that it is really interesting and important to follow how free trade negotiations are improving between EU and Mercosur, because obviously free trade agreement with EU would have a huge impact for foreign trade. For Finnish investors it could be said that Finland has signed the investment agreement with Argentina in 1996. One of the key agendas of actual government is to improve free trade agreement also bilaterally with countries such as important neighbor Chile and huge trade partner China.

Argentina is culturally fantastic country which is really well-known of tango, theaters, cattle raising, football, red wine and high quality meet. However, the country is much more. Argentina has high level of natural resources such as mineral, natural gas and oil.

Traditionally Argentina is well-known for its agricultural products such as soybean, wheat, corn, etc. Agricultural industry is mainly located in the centre and north. On the other hand Andean mountains determine the west side of the country which soil is rich of minerals such as copper, silver and gold.

Last but not least, extremely beautiful Patagonia contains fish industry and natural resources such as petroleum, shale oil and shale gas.

We heard President Macri’s center-right coalition performed well in congressional elections in Argentina in October this year. Which kind of reforms are expected to take place after these elections?

Argentinian parliament had mid-terms election in the end of October 2017. Macri’s “Cambiemos” or “Let’s Change” coalition won the top five population centers of Buenos Aires City, and Buenos Aires, Cordoba, Santa Fe and Mendoza provinces. No single party had won all five in a mid-term vote since 1985. It could be said that the mid-term election were important win for Macri’s coalition also strengthing the mandate in reform agenda. Some months before election market and some analyst were a bit qualified what will happen if “Cambiemos” coalition would lose the mid-term elections. However, the outcome boosted the actual government’s agenda even further and important to mention the defeat Christina Kirchner and Kirchnerism in Buenos Aires province was a significant milestone.

The first goal after the mid-term election is to pass the 2018 budged in Congress not forgetting the importance to take control of country’s fiscal deficit. Macri commented straight after the election result that big target is pass tax reform. Macri commented in Bloomberg interview that the government plans to reduce income tax, custom duties and taxes at state and city levels. The objective is to stoke the economy so that any lost revenue is recovered through increased productivity and less tax evasion. Ideally, the plan will have a neutral impact on the budget, but Macri warned that there is little room to increase taxes and no decision has been taken on whether to tax Argentina’s financial industry. (Source: 1)

Based on the Argentinean Investment & Trade Agency research, Argentina has more than USD 265Bn investment opportunities in sectors such as infrastructure, telecommunication and it, oil & gas, agricultural, mining, energy and especially renewable energy. Infrastructure sector investment plan solely is more than USD 140Bn.

Which kind of impact the mentioned measures will have on Argentina-Finland investment relation?

For Finnish companies Argentina offers big investment opportunities especially in infrastructure, renewable energy and telecommunication, mobile network and capital markets. After years of isolation trade policy Argentina has gap in almost every sector. Government has also provided new legal framework for Public-Private Partnership in order to provide stronger safety net for big investors in infrastructure sector. Additionally, the government has passed new entrepreneurship law to facilitate business environment, providing support to entrepreneurs, IT start-up acceleratos, and local & foreign investors in related ventures.

For Finnish companies Argentina offers big opportunities in energy, industrial and IT sectors. After years of no investments in the sector, the country has a power shortage. This provides opportunities in the mentioned sector.

In energy sector investment Argentinian main focus is on renewable energy which the country has to offer (wind, solar, hydro, gas, oil, biomass, etc). Interestingly Wärtsilä is alreay participating for Renovar project.

Turning to technology, Finland is worldly known by its disruptive technology companies, and it’s not by chance that the main Finnish companies in the sector are targeting Argentinean tech start-ups, getting back to 90’s when Argentina used to be the main hub for tech start-ups in the region, based in Buenos Aires, its capital city. Since 2016 foreign investors has started to return to the country. With highly skilled labor force Argentinean tech-companies offer unique opportunities compared to rest of Latin American region countries.

On the other hand Finland’s public sector is already participating Argentinian education reforms. In G20 meeting the president of Argentina also pointed out the need of educational improvements.

As a conclusion it could be said that all in all the current administration acts have had and will have a huge effect for economic situation and investment opportunities.

EY has an office in Argentina. How EY supports companies in Finland and Argentina to do business?

EY is one of the Big4 companies offering professional consultancy services worldwide. EY has offices along Argentina, the biggest located in Buenos Aires. Importantly, EY has more than 60 offices and around 20 000 employees in Latin America. EY supports companies in assurance, tax, law, financial consulting and transaction services.

With all this support, EY Finland Latin American Desk can provide tailored services for Finnish companies by taking into account Finnish entities’ needs. Depending on those, EY Finland can contact Argentinian colleagues in the case that there is a need e.g. local tax consultancy.

Thank you very much!

Reference:

Other sources used for this report include: Argentinean Investment & Trade Agency, Bloomberg, Reuters, EY internal analysis, Econviews among others.

Janne Aalto | Manager

+358 50 4314 299

janne.aalto@fi.ey.com

Rodrigo de la Cruz López, CFA

+358 50 3318 697

rodrigo.de.la.cruz.lopez@fi.ey.com